UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to sec. 240.14a-12 |

SUMMIT HEALTHCARE REIT, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Summit Healthcare REIT, Inc.

2 South Pointe Drive, Suite 100

Lake Forest, CA 92630

Proxy Statement and

Notice of Annual Meeting of Stockholders

To Be Held NovemberAugust 9, 20172018

Dear Stockholder:

We cordially invite you to attend the 20172018 Annual Meeting of Stockholders of Summit Healthcare REIT, Inc., to be held NovemberAugust 9, 2017,2018, at 10:00 a.m. local time at our corporate offices located at 2 South Pointe Drive, Suite 100 in Lake Forest, CA 92630. Directions to the annual meeting can be obtained by calling (800) 978-8136 or visiting www.summithealthcarereit.com.

We are holding this meeting to:

| 1. | Elect three directors to hold office for one-year terms expiring in |

2019.

Your Board of Directors recommends a vote FOR each nominee.

| 2. |

Your Board of Directors recommends a vote FOR the compensation paid to our executive officers.

| Attend to such other business as may properly come before the meeting and any adjournment or postponement thereof. |

Your Board of Directors has selected SeptemberJune 12, 20172018 as the record date for determining stockholders entitled to vote at the annual meeting.

The Proxy Statement and Proxy Card are being mailed to you on or about SeptemberJune 25, 2017.2018. The 20162017 Annual Report to Stockholders was mailed to you on April 5, 2017.March 23, 2018.

Whether you plan to attend the meeting and vote in person or not, we urge you to have your vote recorded as early as possible. Stockholders have the following three options for submitting their votes by proxy: (1) via the internet; (2) by telephone; or (3) by mail, using the enclosed proxy card.

Your vote is very important! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votesvotes..

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR THE Our Proxy Statement, form of Proxy Card and 2017 Annual Report to Stockholders are also available at https://www.proxy-direct.com/sum-30010. Thank you for your support of Summit Healthcare REIT, Inc. |

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 9, 2017:

Our Proxy Statement, form of Proxy Card and 2016 Annual Report to Stockholders are also available athttps://www.proxy-direct.com/sum-29226. Thank you for your support of Summit Healthcare REIT, Inc.

| Sincerely, | |

| June 25, 2018 | |

| Kent Eikanas | |

| Lake Forest, California | President and Chief Operating Officer |

SUMMIT HEALTHCARE REIT, INC.

2 South Pointe Drive, Suite 100

Lake Forest, California 92630

PROXY STATEMENT

20172018 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD NOVEMBERAUGUST 9, 20172018

We are providing these proxy materials in connection with the solicitation by the Board of Directors (the “Board”) of Summit Healthcare REIT, Inc. (“we,” “us,” “Summit” or the “Company”), a Maryland corporation, of proxies for use at the 20172018 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on NovemberAugust 9, 2017,2018, at 10:00 a.m. local time at our executive offices, 2 South Pointe Drive, Suite 100, Lake Forest, CA 92630, and at any adjournment or postponement thereof, for the purposes set forth in the Notice of Annual Meeting of Stockholders.

This Proxy Statement, form of proxy and voting instructions are first being mailed to stockholders on or about SeptemberJune 25, 2017.2018.

Stockholders Entitled to Vote

Holders of our common stock at the close of business on SeptemberJune 12, 20172018 (the “Record Date”) are entitled to receive notice of and to vote their shares at the Annual Meeting. As of the Record Date, there were 23,027,978 shares of our common stock outstanding. Each share of common stock is entitled to one vote on each matter properly brought before the Annual Meeting.

HOW TO VOTE IF YOU ARE A STOCKHOLDER OF RECORD:

For those stockholders with Internet access, we encourage you to vote via the Internet, since it is quick, easy, convenient and provides a cost savings to the Company. When you vote via the Internet or by telephone prior to the meeting date, your vote is recorded immediately and there is no risk that postal delays will cause your vote to arrive late and, therefore, not be counted. For further instructions on voting, see the enclosed proxy card. Internet voting is permitted by Section 2-507(c)(3) of the Maryland General Corporation Law. Alternatively, you may simply mark your proxy card, date and sign it, and return it in the postage-paid envelope provided.

Voting by proxy will not limit your right to vote at the Annual Meeting if you decide to attend in person. If your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting.

All proxies that have been properly authorized and not revoked will be voted at the Annual Meeting. If you submit a proxy but do not indicate any voting instructions, the shares represented by that proxy will be voted FOR the election of each of the three nominees named herein, FOR the approval of the compensation of our named executive officers and, if any other business properly comes before the stockholders for a vote at the Annual Meeting, your shares will be voted in the discretion of the holders of the proxy.

Your vote is important. You can save the expense of a second mailing by voting promptly.

HOW TO VOTE IF YOU ARE A STOCKHOLDER OF RECORD: For those stockholders with internet access,we encourage you to vote via the internet, since it is quick, easy, convenient and provides a cost savings to the Company. When you vote via the internet or by telephone prior to the meeting date, your vote is recorded immediately and there is no risk that postal delays will cause your vote to arrive late and, therefore, not be counted. For further instructions on voting, see the enclosed proxy card. Internet voting is permitted by Section 2-507(c)(3) of the Maryland General Corporation Law. Alternatively, you may simply mark your proxy card, date and sign it, and return it in the postage-paid envelope provided. Voting by proxy will not limit your right to vote at the Annual Meeting if you decide to attend in person. If your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting. All proxies that have been properly authorized and not revoked will be voted at the Annual Meeting. If you submit a proxy but do not indicate any voting instructions, the shares represented by that proxy will be voted FOR the election of each of the three nominees named herein, and, if any other business properly comes before the stockholders for a vote at the Annual Meeting, your shares will be voted in the discretion of the holders of the proxy. Your vote is important. You can save the expense of a second mailing by voting promptly. |

Required Vote

The presence, in person or by proxy, of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum. If a share is represented for any purpose at the Annual Meeting, it is deemed to be present for quorum purposes and for all other purposes as well. A stockholder may withhold his or her vote in the election of directors or abstain with respect to each other item submitted for stockholder approval. Withheld votes and abstentions will be counted as present and entitled to vote for purposes of determining the existence of a quorum. Withheld votes in the election of directors and abstentions in all other items submitted for stockholder approval will not be counted as votes cast.

Election of Directors.A majority of the votes present in person or by proxy at the Annual Meeting is required for the election of the directors. This means that a director nominee needs to receive more votes for his or her election than against his or her election in order to be elected to the Board. Because of this majority vote requirement, withheld votes will have the effect of a vote against each nominee for director.

As described in more detail below, broker non-votes will also have the effect of a vote against each nominee for director.

Advisory Vote on the Compensation Paid to Our Named Executive Officers. The affirmative vote of a majority of the total votes cast at the Annual Meeting for or against this proposal is required to approve, on an advisory, non-binding basis, the compensation paid to our named executive officers. Abstentions and broker non-votes are not considered votes cast and will have no effect on the outcome of this matter.

Other Matters.Our Board does not presently intend to bring any business before the Annual Meeting other than the proposals identified in the Notice of Annual Meeting of Stockholders and discussed in this Proxy Statement. If other matters are properly presented at the Annual Meeting for consideration, the persons named in the proxy will have the discretion to vote on those matters for you. As of the date of this Proxy Statement, we did not know of any other matters to be raised at the Annual Meeting.

Broker Non-Votes

A broker that holds shares in “street name” generally has the authority to exercise its discretion and vote on routine items when it has not received instructions from the beneficial owner. A broker that holds shares in “street name” does not have the authority to vote on non-routine items when it has not received instructions from the beneficial owner.Votes for the election of directors and the advisory vote on the compensation paid to our named executive officers are considered non-routine matters; therefore, absent your instructions, a broker that holds your shares in “street name” will not be permitted to vote your shares in the election of any nominee for director or for the advisory vote on the compensation paid to our named executive officers. If the broker returns a properly executed proxy, the shares are counted as present for quorum purposes. If a broker returns a properly executed proxy, but crosses out non-routine matters for which you have not given instructions (a so-called “broker non-vote”), the proxy will have the same effect as a vote “AGAINST” the election of each of the three nominees named herein but will have no effect on the advisory vote on the compensation paid to our named executive officers.herein.

Revocation of Proxies

You can revoke your proxy at any time before it is voted at the Annual Meeting by:

voting your shares in person at the Annual Meeting. |

Proxy Solicitation

The solicitation of proxies for the Annual Meeting will be made primarily by mail. However, if necessary to ensure satisfactory representation at the Annual Meeting, we may also solicit proxies by telephone or in person. We have engaged Computershare Fund Services to assist with the solicitation of proxies in conjunction with the Annual Meeting. We anticipate that the aggregate fees for these services will be between $30,000 and $35,000. However, the exact cost will depend on the amount and types of services rendered. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to the owners of our common stock. Our executive officers and regular employees may also solicit proxies, but they will not be specifically compensated for these services. The costs of the proxy solicitation will be borne by the Company.

| 2 |

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board currently consists of three members,members: J. Steven Roush and Suzanne Koenig, both of whom have been determined by the Board to be “independent” as that term is defined under our charter, the NASDAQ listing standards and the rules of the U.S. Securities and Exchange Commission (the “SEC”), and Kent Eikanas. Our Board has proposed the following nominees for electionre-election as directors, each to serve for a one-year term ending at the 20182019 Annual Meeting of Stockholders: J. Steven Roush, Suzanne Koenig and Kent Eikanas. Each nominee currently serves as a director, and, if re-elected, will continue in office until his or her successor has been elected and qualified, or until his or her earlier death, resignation or retirement.

We expect each nominee standing for re-election as a director to be able to serve if elected. If any nominee is not able to serve, proxies will be voted in favor of the remainder of those nominated and may be voted for substitute nominees, unless the Board chooses to reduce the number of directors serving on the Board.

OUR BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR”

ALL NOMINEES TO BE ELECTED AS DIRECTORS

The principal occupation and certain other information about the nominees are set forth below.

J. Steven Roush, CPA, age 71, serves on our Audit, Independent Directors, Compensation and Investment Committees. Mr. Roush chairs our Board of Directors and our Audit Committee. Mr. Roush’s term on our Board and the Committees noted above will expireexpires on the date of the 20172018 Annual Meeting. Mr. Roush retired from PricewaterhouseCoopers in 2007 after 39 years, 30 of those as a Partner. Mr. Roush brings experience in a diverse number of industries ranging from manufacturing, non-profits and retail (restaurants) with a concentrationconcentrations in real estate (office, residential, hospitality and commercial) telecommunications and pharmaceutical. He has a background in dealing with both private and public company boards of directors. Mr. Roush has a Bachelor of Science Degree in Accounting from Drake University and an Advanceda Masters Professional Director Certification from the American College of Corporate Directors.

Mr. Roush brings to our Board years of dealing with the SEC and its various regulatory filings, required by the SEC, Sarbanes Oxley (SOX 404) implementation and maintenance and the experience of working with many diverse boards running across varied industries. Over the years, he has served as an office managing partner, an SEC Review Partner (over 20 years) and a Risk Management Partner. Mr. Roush currently serves as Chairman of the Board and Chairman of the Audit Committee of W.E. Hall Company, a privately held manufacturer and distributor of corrugated pipe and related drainage products. Mr. Roush is also on the Board of Trustees and Chairman of the Audit Committee of the Orange County Museum of Art. He previously served six years on the Audit Committee of the National American Heart Association. He was also a member of the Board and Chairman of the Audit committee of AirTouch Communications, Inc., a public telecommunication device company and Staar Surgical Company, a public manufacturer of implantable lenses for the eye. Our Board has determined that Mr. Roush satisfies the SEC’s requirements of an “audit committee financial expert.”

Suzanne Koenig, age 57,58, serves on our Audit, Independent Directors, Compensation and Investment Committees. Ms. Koenig’s term on our Board and the Committees noted above will expireexpires on the date of the 20172018 Annual Meeting. Ms. Koenig is president and founder of SAK Management Services LLC, a nationally recognized long-term care management and healthcare consulting services company, where she has worked for 1718 years. With over 3020 years of extensive experience as an owner and operator, Ms. Koenig offers specialized skills in operations improvement, staff development and quality assurance with particular expertise in marketing, census development and operations enhancement for the whole spectrum of senior housing, long-term care and other healthcare entities requiring turnaround services.

| 3 |

Ms. Koenig’s professional experience has included executive positions in marketing, development and operations management for both regional and national health carehealthcare providers representing property portfolios throughout the United States. Recently Ms. Koenig has been appointed as the Patient Care Ombudsman, Examiner, Receiver and Chapter 11 Trustee in several of the new health care bankruptcy filingsHealth Care Bankruptcy Filings (Chapter 11 and Chapter 7) with the advent of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, (BAPCPA), including healthcare entities such as physician practices and hospitals.

In addition, Ms. Koenig has served in an advisory and consulting capacity for numerous client engagements involving bankruptcy proceedings as well as in turnaround management situations. She offers proven proficiency in maximizing financial return and cash flow, while maintaining the highest standards of quality care.

Ms. Koenig brings to our Board approximately 30 years of experience in operating long-term care facilities. Ms. Koenig offers the practical perspective of the challenges and opportunities confronting healthcare providers in managing the changing dynamics of this industry. She is a Certified Turnaround Practitioner, a Licensed Nursing Home Administrator and a Licensed Social Worker in multiple Statesstates where she has worked.

Ms. Koenig also serves as an officer and director for several of the States’states’ long term care provider associations. Ms. Koenig is the current Co-Chair of the American Bankruptcy Institute’s (ABI) Health Care Insolvency Committee and Ms. Koenig is a Board of Trustee toDirector for the Global Turnaround Management Association (TMA).

Chapter. Ms. Koenig is a frequent speaker for various healthcare industry associations and business affiliates where she conducts continuing education and training programs. She holds a Master of Science Degree from Spertus College, Illinois, and a Bachelor of Social Work Degree from the University of Illinois, Champaign-Urbana, Illinois.

Kent Eikanas, age 47,48, currently serves as our President and Chief Operating Officer. AdditionalFurther information regarding Mr. Eikanas’ business experience and specific skills that qualify him to serve as a director of the Company is set forth below in the “Executive Officers” section. Mr. Eikanas’ term on our Board expires on the date of the 2018 Annual Meeting. See below for Mr. Eikanas’ biography.

Board Leadership Structure

Our Board is currently comprised of three members,members: Mr. Roush and Ms. Koenig, both of whom are independent directors, and Mr. Eikanas, our President and Chief Operating Officer.

Our Board composition and the corporate governance provisions set forth in our charter ensure strong oversight by independent directors. Each of our Board’s standing committees is currently chaired by, and comprised of, independent directors. Although our Board has not established a policy, one way or the other, on whether the role of the Chairman and Chief Executive Officer should be separated, the Board has determined it would be preferable, at least for the foreseeable future, that the roles of Chairman and Chief Executive Officer be separated. Currently the position of Chief Executive Officer is vacant. As the current Chairman of the Board, Mr. Roush is responsible for chairing Board meetings and meetings of stockholders, setting the agendas for Board meetings and providing information to the other directors in advance of meetings and between meetings. We do not currently have a policy requiring the appointment of a lead independent director.

The Role of the Board of Directors in our Risk Oversight Process

Management is responsible for the day-to-day management of risks that the Company faces, while our Board, as a whole and through its committees, has responsibility for the oversight of risk management. The full Board regularly reviews information regarding the Company’s liquidity, credit, operations and regulatory compliance, as well as the risks associated with each. The Audit Committee oversees risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements. The Independent Directors Committee manages risks associated with the independence of the Board. Although each committee is responsible for evaluating certain risks and overseeing the management of such risks, our full Board is regularly informed through committee reports about such risks as well as through regular reports directly from officers responsible for oversight of particular risks within the Company.

| 4 |

Director Independence

Our charter contains detailed criteria for determining the independence of our directors and requires a majority of the members of our Board to qualify as independent. The Board consults with our legal counsel to ensure that the Board’s independence determinations are consistent with our charter and applicable securities and other laws and regulations. Consistent with these considerations, after reviewing all relevant transactions or relationships between each director, or any of his family members and the Company, our senior management and our independent registered public accounting firm, each of Mr. Roush and Ms. Koenig has been determined to be independent. Furthermore, although our shares are not listed on a national securities exchange, our Board reasonably believes that each of Mr. Roush and Ms. Koenig and, thus, each member of the Board’s Audit Committee, Independent Directors Committee, Compensation Committee and Investment Committee is independent under the NASDAQ listing standards. If each nominee for director –— Mr. Roush, Ms. Koenig, and Mr. Eikanas –— is elected to the Board at the Annual Meeting, our Board will continue to have strong independent oversight as each such nominee other than Mr. Eikanas will continue to qualify as an independent director.

Nomination of Candidates for Director Positions

We have determined that we are better served by having our full Board review director nominations. Therefore, we have no nominating committee; however, pursuant to our charter, our independent directors are responsible for nominating all replacements for vacancies resulting from the departure of independent directors. Our full Board participates in the consideration of all other director nominees. Specifically, our Board identifies nominees by first evaluating the current members of our Board willing to continue in service. Current members of our Board with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination. If any member of our Board standing for re-election at an upcoming Annual Meeting of Stockholders does not wish to continue in service, the Board identifies the desired skills and experience of a new nominee.

Our Board believes that potential directors should possess sound judgment, an understanding of the business issues affecting us, integrity and the highest personal and professional ethics. In searching for potential nominees, our Board (or the independent directors, if the nomination is for a vacant independent director position) seeks directors who have extensive relevant business, management and civic experience appropriate for assisting our Board to discharge its responsibilities. In the case of both incumbent and new directors, our Board seeks persons who can devote significant time and effort to board and committee responsibilities. In addition, when selecting new nominees for director positions, our Board seeks to develop and maintain a board that, as a whole, is strong in its collective knowledge and has a diversity of skills, background and experience with respect to accounting and finance, management and leadership, vision and strategy, business operations, industry knowledge and corporate governance.

Our Board will consider recommendations made by stockholders for director nominees who meet the criteria set forth above. In order to be considered for nomination, recommendations made by stockholders must be submitted within the timeframe required to request a proposal to be included in the proxy materials. See “Additional Information – Stockholder Proposals” below.

Meetings of the Board of Directors and Committees

During the fiscal year ended December 31, 2016,2017, our full Board formally met four times and took action by unanimous written consent 11nine times. During 2016,2017, each of our directors attended all of the meetings of our full Board. In addition, each director attended all of the meetings of the committees on which he or she served during 2016.2017. We encourage our directors to attend our Annual Meetings of Stockholders. All of our directors were present in person at our 20162017 Annual Meeting of Stockholders. Our full Board considers all major decisions concerning our business, including any property acquisitions. However, our Board has established committees so that certain functions can be addressed in more depth than may be possible at a full board meeting. Our Board has established four standing committees: the Audit Committee, the Independent Directors Committee, the Compensation Committee and the Investment Committee.

Audit Committee

Our Audit Committee selects the independent public accountants that audit our annual financial statements, reviews the plans and results of the audit engagement with those accountants, approves the audit and non-audit services provided by those accountants, reviews the independence of those accountants, considers the range of audit and non-audit fees and reviews the adequacy of our internal accounting controls. The current members of our Audit Committee are J. Steven Roush and Suzanne Koenig. J. Steven Roush, CPA, serves as the Chairman of our Audit Committee and satisfies the SEC’s requirements of an “audit committee financial expert.” During the fiscal year ended December 31, 2016,2017, our Audit Committee met four times. Our Audit Committee has adopted a charter which is available on our website.

| 5 |

Independent Directors Committee

In order to reduce or eliminate certain potential conflicts of interest, our independent directors approve all transactions between the Company and its affiliates. See “Certain Transactions with Related Persons” below for a discussion of the transactions considered and approved by our Independent Directors Committee since the beginning of 2016.2017. In general, our independent directors are authorized to retain their own legal and financial advisors at our expense and are empowered to act on any matter permitted under Maryland law. Any conflict-of-interest matters that cannot be delegated to a committee under Maryland law must be acted upon by both our full Board and our independent directors. The current members of our Independent Directors Committee are J. Steven Roush and Suzanne Koenig. During the fiscal year ended December 31, 2016,2017, our Independent Directors Committee met four times.

Compensation Committee

Our Compensation Committee discharges our Board’s responsibilities relating to compensation of our executive officers. Our Compensation Committee also has authority to retain its own legal and other advisors and create and administer incentive compensation and equity-based plans. The current members of our Compensation Committee are J. Steven Roush and Suzanne Koenig. Our Compensation Committee met once during the fiscal year ended December 31, 2016.2017. Our Compensation Committee has adopted a charter, which is available on our website.

Investment Committee

Our Investment Committee’s principal responsibility is to review the real estate investments proposed to be made by the Company, including investments in real estate through joint ventures, and to confirm that the real estate investments selected by our management are consistent with the investment limitations set forth in our charter and consistent with our acquisition policies, our primary investment focus, property selection criteria and conditions to closing. Our Investment Committee currently consists of J. Steven Roush and Suzanne Koenig. During the fiscal year ended December 31, 2016,2017, our Investment Committee met four times.

Communication with Directors

We have established procedures for stockholders or other interested parties to communicate directly with our Board. They may contact the Board by mail at: Chairperson of the Audit Committee of Summit Healthcare REIT Inc., 2 South Pointe Drive, Suite 100, Lake Forest, CA 92630. The Chairperson of our Audit Committee will receive all communications made by this means.

Code of Business Conduct and Ethics

Our Board has adopted a Code of Business Conduct and Ethics that is applicable to all members of our Board, our executive officers, and our employees. Our Code of Business Conduct and Ethics can be accessed through our website:www.summithealthcarereit.com. If, in the future, we amend, modify or waive a provision in our Code of Business Conduct and Ethics, we may, rather than filing a Current Report on Form 8-K, satisfy the disclosure requirement by posting such information on our website.

Executive Officers

Mr. Kent Eikanas is our President and Chief Operating Officer and Secretary.Officer. Our Chief Financial Officer and Treasurer is Ms. Elizabeth Pagliarini.

| 6 |

Kent Eikanas, age 47,48, currently serves as our President and Chief Operating Officer. Mr. Eikanas has served as Chief Operating Officer and has successfully repositioned the Company from industrial to senior housing.President since July 2012. From 2008 to 2012, Mr. Eikanas served as Vice President of Senior Housing for Granite Investment Group (“Granite”),a private equity group, where he closed over $100 million in senior housing real estate refinances, dispositions and acquisitions. In addition, Mr. Eikanas managedwas responsible for asset management of over $700 million in senior housing assets. Mr. Eikanasassets, was a key contributor to the launch of a skilled nursing operating company based in Dallas, Texas, while at Granite andas well as helped grow the operating company grow from 14 facilities to 35 facilities. From 2003 to 2008, Mr. Eikanas was the Vice President of Acquisitions for a private real estate company and closed over $200 million in senior housing real estate. Mr. Eikanas has overseen licensing for skilled nursing facilities, assisted living facilities and memory care facilities in California, Texas, Rhode Island, Oregon and Pennsylvania. From 1999 to 2003, Mr. Eikanas worked in sales and real estate for REMAX. Mr. Eikanas graduated from California State University Sacramento with a Bachelor of Arts Degree in Psychology and a minor in Business Administration. Mr. Eikanas is a frequent speaker on healthcare real estate.

Elizabeth Pagliarini, age 46,47, currently serves as our Chief Financial Officer.Officer and Treasurer and has been with the Company since June 2014 and has served as Chief Financial Officer and Treasurer since September 2014. Ms. Pagliarini is a seasoned executive with over 25 years of experience in financial services and investment banking having held positions including chief executive officer, president, chief financial officer and chief compliance officer. Her background includes experience in finance, accounting, operations, compliance, securities litigation and executive management.

Ms. Pagliarini successfully broke the “glass ceiling” in her mid-twenties as chief executive officer and chairwoman of the board of an investment brokerage subsidiary of a public company in Beverly Hills, California. She also co-founded a boutique investment bank and registered broker-dealer.

Prior to working at Summit, Ms. Pagliarini was a principal at a securities litigation and financial consulting firm since 2001 and chief compliance officer and FINOP (financial and operations principal) at a Los Angeles-based investment bank from 2005-2008. Ms. Pagliarini received her Bachelor of Science in Business Administration with a concentration in Finance from Valparaiso University where she was honored with their highest academic award, the Presidential Scholarship. She is also a Certified Fraud Examiner (CFE) and has studied law and forensic accounting at UCLA.

Ms. Pagliarini proudly serves on the Emeritus Board of Directors for Forever Footprints, a non-profit organization that provides support to families that have suffered the loss of a baby during pregnancy or infancy and educates the medical community to improve quality of care and response.

Ms. Pagliarini was named one of “20 Women to Watch” by OC Metro magazine and nominated for The Orange County Business Journal’s Women in Business Award. She has also been honored by Step Up Women’s Network as the recipient of their prestigious Commitment to Philanthropy Volunteer Award. She has been interviewed by The Wall Street Journal, The Los Angeles Times, The Hedge Fund Law Report, The Daily Deal, Washington Business Journal,several business and Fortune among others,finance publications and has been a guest on business talk radio.asked to speak at various financial and industry events and conferences.

Executive Compensation

Compensation Philosophy

Our Compensation Committee strives to align the interests of our executive officers and stockholders through a simple and transparent executive compensation program that we established in 2015. We offer our executive officers a combination of fixed and performance-based compensation, with a significant portion of such compensation taking the form of cash and equity bonuses when the Company’s financial and strategic goals are achieved. We believe that this compensation philosophy strikes the balance of fostering the creation of long-term value for our stockholders, incentivizing and retaining our talented executive team and promoting prudent risk management.

Compensation Discussion

We became a self-managed REIT upon the effective termination of our Advisory Agreement with Cornerstone Realty Advisors, LLC (“CRA”) on April 1, 2014. Our transition to self-management required us to internalize our operations and hire employees and an executive team for the first time in our Company’s history. This transition, coupled with the repositioning strategy we initiated in 2012, created a challenging environment for us and our executive team. Nonetheless, since 2012, our executive team has successfully completed all three phases of our repositioning strategy, culminating with raising institutional third party capital through our participation in multiple joint ventures (the “Joint Ventures”). Consistent with our strategy to create opportunities that are accretive to stockholder value, our Joint Ventures entitle us to acquisition fees, annual asset management fees, and most significantly, a waterfall return of cash flows and all capital proceeds (from the sale of the properties, refinancing, or other capital events) from the joint venture portfolios. Our Joint Ventures will enable us to continue our strategy of acquiring additional senior housing facilities and building a diversified portfolio to increase cash flow from operations and stockholder value. Thus, our executive team has been tasked and incentivized to continue raising institutional third party capital for further growth of the Company by participating in more joint venture transactions.

| 7 |

Compensation Program

Our executive compensation program is intended to align the interests of our executive officers with the interests of our stockholders, attract and retain talented executive officers, reward exceptional performance and promote teamwork and collaboration among the executive team.

Our executive compensation program consists of four elements: base salaries, annual cash incentive compensation, annual equity awards and severance benefits. We believe our executive compensation program is appropriately structured to accomplish our objectives above.

Our executive officers may earn equity compensation in the form of incentive stock options for meeting specific management objectives determined by the Board.

Independent Compensation Consultant

In determining the total compensation of our executive officers, ourOur Compensation Committee is assisted byhas not engaged an independent compensation consultant. Inconsultant since 2015, when we established our Compensation Committee engaged VisionLink Advisory Group (the “Compensation Consultant”) to review and analyze our priorcurrent executive compensation program and our proposed executive compensation program and compare it with compensation programs at similar peer companies.program.

The Compensation Consultant neither performed any other services for us, nor received any fees from us, that were not related to its review and analysis of our executive compensation program, and our management and the Compensation Committee determined that the Compensation Consultant was independent, based in part on the following additional reasons:

Historical Executive Compensation

The following table provides certain information concerning compensation for services rendered in all capacities by our named executive officers during the fiscal years ended December 31, 20162017 and 2015.2016.

| Name and Principal Position | Year | Salary | Bonus | Option Awards | Total | ||||||||||||

| Kent Eikanas President & Chief Operating | 2016 | $ | 300,000 | $ | 287,103 |

- | $ | 587,103 | |||||||||

| Officer | 2015 | $ | 300,319 | $ | 234,784 | 59,700 | $ | 595,803 | |||||||||

Elizabeth Pagliarini Chief Financial Officer and | 2016 | $ | 200,000 | $ | 167,366 |

- | $ | 367,366 | |||||||||

| Treasurer | 2015 | $ | 200,000 | $ | 117,892 | 19,900 | $ | 337,792 | |||||||||

| Peter Elwell(1) | 2016 | $ | 75,811 | $ | 32,108 | - | $ | 107,919 | |||||||||

| Chief Investment Officer | 2015 | $ | 200,000 | $ | 117,892 | 19,900 | $ | 337,902 | |||||||||

| Name and Principal Position | Year | Salary | Bonus | Option Awards(1) | Total | |||||||||||||

| Kent Eikanas | 2017 | $ | 335,055 | (2) | $ | 277,378 | $ | 70,180 | $ | 682,613 | ||||||||

| President & Chief Operating Officer | 2016 | $ | 300,000 | $ | 287,103 | — | $ | 587,103 | ||||||||||

| Elizabeth Pagliarini | 2017 | $ | 221,978 | (3) | $ | 184,919 | $ | 47,787 | $ | 454,684 | ||||||||

| Chief Financial Officer and Treasurer | 2016 | $ | 200,000 | $ | 167,366 | — | $ | 367,366 | ||||||||||

| (1) |

| (2) | This includes $34,615 paid in 2017 that relates to unused paid time off earned in 2016. |

| (3) | This includes $21,538 paid in 2017 that relates to unused paid time off earned in 2016. |

Employment Agreements with Named Executive Officers

On September 23, 2015, the Company entered into employment agreements with each of its named executive officers, Kent Eikanas, President and Chief Operating Officer, and Elizabeth Pagliarini, Chief Financial Officer and Treasurer. These employment agreements were approved by the Company’s Compensation Committee and Board of Directors. Each employment agreement has a three-year term and contains standard terms relating to salary, bonus, position, duties and benefits (including eligibility for equity compensation), as well as a special cash payment following a change in control of the Company. The initial base salaries for each of Mr. Eikanas and Ms. Pagliarini arewere as follows: $300,000 and $200,000 per year, respectively, and are subject to annual merit increases. In December 2017, the Company’s Compensation Committee approved an increase to the base salaries effective January 1, 2018, for each of Mr. Eikanas and Ms. Pagliarini to $335,000 and $225,000 per year, respectively.

| 8 |

Potential Payments upon Termination or Change in Control

If there is a termination of employment by the Company without cause or by the named executive officer for good reason, then the named executive officer will be entitled to receive payment of any base salary amounts that have accrued but not been paid as of the termination date, any accrued but unused paid time off, expenses not yet reimbursed, vested benefits accrued through the termination date payable pursuant to the plans providing such benefits and cash severance in the amount equal to two (2) times base salary for Mr. Eikanas and one (1) times base salary for Ms. Pagliarini. In addition, all options granted to the executive under the Summit Healthcare REIT, Inc. 2015 Omnibus Incentive Plan that otherwise were unvested shall immediately and fully accelerate and shall be deemed to be vested, and the executive shall be entitled to reimbursement for monthly COBRA premiums.premiums until the earliest of (A) the eighteen (18) month anniversary of the termination date or (B) the date on which executive becomes eligible to enroll in comparable coverage with another employer.

If the Company undergoes a change in control during the executive’s term of employment or within six months after the termination of the executive’s employment for any reason, then the Company will pay a cash bonus in the amount equal to three (3) times base salary for Mr. Eikanas and two (2) times base salary for Ms. Pagliarini. In addition, all options granted to the executive under the Summit Healthcare REIT Inc., 2015 Omnibus Incentive Plan that otherwise were unvested shall immediately and fully accelerate and shall be deemed to be vested.

Director Compensation

During the 2016 fiscal year, we paid each of our independent directors a quarterly retainer of $15,000 per quarter.

In the event that a director is also one of our full time executive officers, we do not pay any compensation for services rendered as a director. The amount and form of compensation payable to our directors for their service to us is determined by the Compensation Committee of our Board, based in part on its evaluation of third party board compensation information. If a director is also one of our full time executive officers, we do not pay any compensation for services rendered as a director.

Name | Fees Earned or Paid in Cash in 2016 | |||

| Paul Danchik | $ | 24,667 | (1) | |

| J. Steven Roush | $ | 75,000 | ||

| Suzanne Koenig | $ | 73,000 | ||

The following table summarizes the annual compensation received by our independent directors for the fiscal year ended December 31, 2017.

| Name | Fees Earned or Paid in Cash in 2017 | Stock Awards(1) | Total | |||||||||

| J. Steven Roush | $ | 83,000 | $ | 10,500 | $ | 93,500 | ||||||

| Suzanne Koenig | $ | 62,000 | $ | 10,500 | $ | 72,500 | ||||||

| (1) |

During fiscal year 2016,2017, we paid each of our independent directors’ compensation as follows:

All directors are reimbursed for all reasonable out-of-pocket expenses incurred in connection with attendance at meetings of the Board and committees.

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the Board, which is responsible for discharging the Board’s responsibilities relating to the compensation of our directors and would be expected to act upon matters of executive compensation as necessary has reviewed and discussed the executive compensation disclosure required by Item 402 of Regulation S-K with management and, in reliance on these reviews and discussions, the Compensation Committee recommended to the Board, and the Board approved, the inclusion of such disclosure in this Proxy Statement.

| The Compensation Committee of the Board of Directors | |

| J. Steven Roush (Chairman) and Suzanne Koenig |

The foregoing report shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or under the Exchange Act except to the extent that we specifically incorporate this information by reference and shall not otherwise be deemed filed under such Acts.

OWNERSHIP OF EQUITY SECURITIES

Summit Healthcare REIT, Inc. 2015 Omnibus Incentive Plan.

In October 2015, we adopted the Summit Healthcare REIT, Inc. 2015 Omnibus Incentive Plan. The purpose of the Omnibus Incentive Plan is to provide a means through which to attract and retain key personnel and to provide a means whereby current or prospective directors, officers, employees, consultants and advisors can acquire and maintain an equity interest in us, or be paid incentive compensation, including incentive compensation measured by reference to the value of our common stock, thereby strengthening their commitment to our welfare and aligning their interests with those of our stockholders.

The Omnibus Incentive Plan provides that the total number of shares of common stock that may be issued under the Omnibus Incentive Plan is 3,000,000.

During 20162017 and 2015,2016, we granted an aggregate of 0396,408 and 500,0000 options to our named executive officers.officers, respectively.

Outstanding Equity Awards as of December 31, 20162017

The following table presents information regarding the outstanding equity awards held by each of our named executive officers as of December 31, 2016,2017, including the vesting dates for the portions of these awards that had not vested as of that date.

| Option Awards | ||||||||||||||

| Name | Number of Securities Underlying Unexercised Options - Exercisable | Number of Securities Underlying Unexercised Options - Unexercisable | Option Exercise Price | Option Expiration Date | ||||||||||

| Kent Eikanas | 300,000 | — | $ | 1.72 | 12/22/2025 | |||||||||

| Kent Eikanas | 73,119 | 36,559 | (1) | $ | 2.02 | 12/1/2026 | ||||||||

| Kent Eikanas | 55,556 | 44,444 | (2) | $ | 2.04 | 4/1/2027 | ||||||||

| Kent Eikanas | 9,449 | 16,718 | (3) | $ | 2.26 | 11/7/2027 | ||||||||

| Elizabeth Pagliarini | 100,000 | — | $ | 1.72 | 12/17/2025 | |||||||||

| Elizabeth Pagliarini | 48,745 | 24,373 | (4) | $ | 2.02 | 12/1/2026 | ||||||||

| Elizabeth Pagliarini | 38,889 | 31,111 | (5) | $ | 2.04 | 4/1/2027 | ||||||||

| Elizabeth Pagliarini | 6,300 | 11,145 | (6) | $ | 2.26 | 11/7/2027 | ||||||||

| 10 |

Option Awards | ||||||||

Name | Number of | Number of | Option | Option | ||||

| Kent Eikanas | 199,000 | 101,000 | $ 1.72 | 12/22/2025 | ||||

| Elizabeth Pagliarini | 66,333 | 33,667 | $ 1.72 | 12/17/2025 | ||||

| (1) |

| (2) | 2,778 stock options vest monthly and become fully vested on April 1, 2019. |

| (3) | 727 stock options vest monthly and become fully vested on November 1, 2019. |

| (4) | 2,031 stock options vest monthly and become fully vested on December 1, 2018. |

| (5) | 1,944 stock options vest monthly and become fully vested on April 1, 2019. |

| (6) | 485 stock options vest monthly and become fully vested on November 1, 2019. |

BeneficialSecurity Ownership of our Directors and Executive OfficersCertain Beneficial Owners

The following table sets forth information as of the Record Date,June 12, 2018, regarding the beneficial ownership of our common stock by each person known by us to own 5% or more of the outstanding shares of common stock. The percentage of beneficial ownership is calculated based on 23,027,978 shares of common stock outstanding as of June 12, 2018.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percentage of Class | ||||||

MPF Badger Acquisition Co., LLC 1640 School Street | ||||||||

| Moraga CA 94556 | 1,316,995.99 | (1) | 5.7 | % | ||||

| (1) | This information is based solely on a Schedule 13G filed November 29, 2017 by MPF Badger Acquisition Co., LLC, MacKenzie Realty Capital, Inc., MacKenzie Income Fund 27, LLC, MPF DeWaay Premier Fund 4, LLC and MPF Income Fund 26, LLC (the “Reporting Persons”). The Schedule 13G reports that MacKenzie Capital Management, LP is the manager of each Reporting Person and has the power to direct the voting or disposition of all 1,316,995.99 shares held by the Reporting Persons. |

Security Ownership of Directors and Executive Officers

The following table sets forth information as of June 12, 2018, regarding the beneficial ownership of our common stock by each of our directors, each of our named executive officers, and our directors and executive officers as a group. The percentage of beneficial ownership is calculated based on 23,027,978 shares of common stock outstanding as of the Record Date.June 12, 2018.

| Amount and | ||||||||||||||||

| Nature of | ||||||||||||||||

| Beneficial | Percentage | |||||||||||||||

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | Percentage of Class | Ownership(1) | of Class | ||||||||||||

| Kent Eikanas | 414,475 | 1.8 | % | 543,533 | 2.4 | % | ||||||||||

| Elizabeth Pagliarini | 180,867 | * | 264,948 | 1.2 | % | |||||||||||

| J. Steven Roush | 8,333 | * | 22,500 | * | ||||||||||||

| Suzanne Koenig | 8,333 | * | 20,278 | * | ||||||||||||

| All current directors and executive officers as a group (4 persons) | 612,099 | 2.7 | % | 851,259 | 3.7 | % | ||||||||||

| * | Less than 1%. |

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities and shares issuable pursuant to options, warrants and similar rights held by the respective person or group that may be exercised within 60 days following |

Other Equity Compensation Plan Information

Our equity compensation plan information as of December 31, 20162017 is as follows:follows:

| Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance | |||||||||

| Equity compensation plans approved by security holders | 400,000 | $ | 1.72 | 2,600,000 | (1) | |||||||

| Equity compensation plans not approved by security holders | — | — | — | |||||||||

| Total | 400,000 | $ | 1.72 | See Footnote | (1) | |||||||

| Number of Securities | ||||||||||||

| to be Issued Upon | Weighted Average | |||||||||||

| Exercise of | Exercise Price of | Number of Securities | ||||||||||

| Outstanding Options, | Outstanding Options, | Remaining Available | ||||||||||

| Plan Category | Warrants and Rights | Warrants and Rights | for Future Issuance | |||||||||

| Equity compensation plans approved by security holders | 895,408 | $ | 1.90 | 2,104,592 | ||||||||

| Equity compensation plans not approved by security holders | — | — | — | |||||||||

| Total | 895,408 | $ | 1.90 | 2,104,592 | ||||||||

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act, requires each director, officer and individual beneficially owning more than 10% of a registered securityour outstanding shares of uscommon stock to file initial statements of beneficial ownership (Form 3) and statements of changes in beneficial ownership (Forms 4 and 5) of common stock of us with the SEC.

Based solely upon our review of copies of these reports filed with the SEC and written representations furnished to us by our officers and directors, we believe that all of the persons subject to the Section 16(a) reporting requirements filed the required reports on a timely basis with respect to fiscal year 2016.2017, except for the following reports:

| Number of Late | ||||||

| Name | Title | Type of Form | Reports | |||

| Kent Eikanas | Director, President and Chief Operating Officer | Form 4 | 3 | |||

| Elizabeth Pagliarini | Chief Financial Officer | Form 4 | 3 | |||

| Steve Roush | Director | Form 4 | 1 | |||

| Suzanne Koenig | Director | Form 4 | 1 |

AUDIT COMMITTEE REPORT

The Audit Committee reviews our financial reporting process on behalf of the Board. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls.

In this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm regarding the fair and complete presentation of our results. The Audit Committee has discussed significant accounting policies applied by us in our financial statements, as well as alternative treatments. Management of the Company represented to the Audit Committee that our consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed in Auditing Standard No. 16,1301, Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board (“PCAOB”PCAOB”).

In addition, the Audit Committee has discussed with the independent registered public accounting firm its independence from us and our management, including the matters in the written disclosures and the letter from the independent registered public accounting firm required by the applicable requirements of the PCAOB regarding the accountant’s communications with the Audit Committee concerning independence. The Audit Committee also has considered whether the independent registered public accounting firm’s provision of non-audit services to us is compatible with its independence. The Audit Committee has concluded that the independent registered public accounting firm is independent from us and our management.

| 12 |

The Audit Committee discussed with our independent registered public accounting firm the overall scope and plans for its audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of its examination, the evaluation of our internal controls, and the overall quality of our financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board, and the Board has approved, that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016,2017, for filing with the SEC. The Audit Committee has selected our independent registered public accounting firm. The following directors, who constitute the Audit Committee, provide the foregoing report.

| The Audit Committee of the Board of Directors | |

| J. Steven Roush (Chairman) and Suzanne Koenig |

The foregoing report shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or under the Exchange Act except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such Acts.

Independent Registered Public Accounting Firm

BDO USA, LLP (“BDO”) has served as our independent registered public accounting firm since fiscal year 2013 and has audited our consolidated financial statements for the years ended December 31, 20162017 and 2015.2016. Our management believes that BDO is knowledgeable about our operations and accounting practices and is well qualified to act as our independent auditor. BDO will attend the annual meeting, have the opportunity to make a statement, and be available to respond to questions.

Audit and Non-Audit Fees

The following table lists the aggregate fees billed for services rendered by BDO USA, LLP, our principal accountant for 20162017 and 2015: 2016:

| Services | 2016 | 2015 | 2017 | 2016 | ||||||||||||

| Audit Fees(1) | $ | 380,725 | $ | 361,890 | $ | 394,769 | $ | 393,866 | ||||||||

| Total | $ | 380,725 | $ | 361,890 | $ | 394,769 | $ | 393,866 | ||||||||

| (1) | Audit fees |

The Audit Committee pre-approves all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for us by our independent auditor, subject to the de minimis exceptions for non-audit services described in Section 10A(i)(1)(B) of the Exchange Act and the rules and regulations of the SEC which are approved by the Audit Committee prior to the completion of the audit.

CERTAIN TRANSACTIONS WITH RELATED PERSONS

The Independent Directors Committee has reviewed the material transactions between the Company and our affiliates (including CRA, our former advisor) since the beginning of 2016,2017, as well as any such currently proposed transactions. Set forth below is a description of such transactions.

Our Relationship with Summit Union Life Holdings, LLC, our equity-method investmentEquity-Method Investments

On April 29, 2015, through our Summit Healthcare Operating Partnership (“We currently have an interest in five equity-method investments (collectively, “Operating Partnership”), we entered into a limited liability company agreement (“SUL LLC AgreementEquity-Method Investments”) with Best Years, LLC (“Best Years”), an unrelated entity and a U.S.-based affiliate of Union Life Insurance Co, Ltd. (a Chinese corporation) and formed Summit Union Life Holdings, LLC (“SUL JV”)(see Note 5 to the Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the year ended December 31, 2017). SUL JV is owned 10% by the Operating Partnership and 90% by Best Years. The SUL JV will continue until an event of dissolution occurs, as defined in the SUL LLC Agreement. We account for our investment using the equity-method.

We serve as the manager of the SUL JVour Equity-Method Investments and provide various services in exchange for fees and reimbursements. All acquisition fees and asset management fees will be paid to Summit Healthcare Asset Management, LLC (the “Management Company”) and expenses incurred by us, as the manager, will be reimbursed from the Management Company. Under the SUL LLC Agreement, Best Years has paid the Management Company a one-time acquisition fee based on the original purchase price paid for the SUL JV properties and other properties acquired in 2015 and 2016 through the SUL JV, totaling approximately $518,000 for 2015 and $157,000 for 2016. Additionally, annual asset management fees to be paid by the SUL JV to the Management Company, equal to 0.25% of the original purchase price paid for the all SUL JV owned properties, totaled approximately $80,000 in 2015 and $274,000 in 2016.

Our Relationship with Summit Fantasia Holdings, LLC, our equity-method investment

On September 27, 2016, through our Summit Healthcare Operating Partnership, we entered into a limited liability company agreement (“Fantasia LLC Agreement”) with Fantasia Investment III LLC (“Fantasia”), an unrelated entity and a U.S.-based affiliate of Fantasia Holdings Group Co., Limited (a Chinese corporation), and formed Summit Fantasia Holdings, LLC (the “Fantasia JV”). The Fantasia JV is not consolidated in our condensed consolidated financial statements and will be accounted for under the equity-method in the Company’s condensed consolidated financial statements.

We serve as the manager of the Fantasia JV and provide management services in exchange for fees and reimbursements. Under the Fantasia LLC Agreement,agreements, as the manager, we are paid an acquisition fee upon closing of an acquisition as defined in the agreement, based on the purchase price paid for the properties. Total acquisition fees earned under the Fantasia LLC Agreement in 2016 were approximately $57,000. Additionally, we are paid on a quarterly basis an annual asset management fee equalbased on the properties in the portfolios, as defined in the agreements. All acquisition fees and asset management fees are paid to 0.75%Summit Healthcare Asset Management, LLC (“SAM TRS”), our consolidated taxable REIT subsidiary, and expenses incurred by us, as the manager, are reimbursed from SAM TRS.

| 13 |

For the year ended December 31, 2017, we received $292,000 in acquisition fees and approximately $546,000 in asset management fees as the manager of the initial capital contribution of the members, which totaled approximately $8,000 in 2016.Equity-Method Investments.

Our RelationshipRelationships with CRA, our former advisor

Until April 1, 2014, and subject to certain restrictions and limitations, our business was managed pursuant to an advisory agreement (the “Advisory Agreement”) with CRA. Beginning AprilPlease refer to Item 3 Legal Proceedings in Part 1 2014, the Company became self-managed and hired employees to directly manage its operations.

Prior to April 1, 2014, the Company engaged in certain related party transactions with CRA relating to fees paid and costs reimbursed to CRA for services rendered to the Company. Those transactions ceased in connection with the termination of the Advisory Agreement. As disclosed in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016,2017 for more information regarding current legal proceedings involving CRA and the Company and certain former directors and current and former officers of the Company are currently involved in a lawsuit which, among other things, relates to certain disputes relating to the certain amounts due from CRA to the Company and certain amounts due from the Company to CRA.Company.

Our Policy regarding Transactions with Affiliates

Our charter requires our Independent Directors Committee to review and approve all transactions involving our affiliates and us. For example, prior to entering into a transaction with an affiliate, a majority of the Independent Directors Committee must have concluded that the transaction was fair and reasonable to us and on terms and conditions not less favorable to us than those available from unaffiliated third parties. Furthermore, our Independent Directors Committee must review at least annually our fees and expenses to determine that the expenses incurred are reasonable in light of our investment performance, our net asset value, our net income and the fees and expenses of other comparable unaffiliated REITs.

Our Code of Business Conduct and Ethics sets forth examples of types of transactions with related parties that would create conflicts of interest between the interests of our stockholders and the private interests of the parties involved in such transactions. Our directors and officers are required to take all reasonable action to avoid such conflicts of interest or the appearance of conflicts of interest. If a conflict of interest becomes unavoidable, our directors and officers are required to report the conflict to a designated ethics contact, which, depending on the circumstances of the transaction, would be either our President, Chief Financial Officer or the Chairman of our Audit Committee. The appropriate ethics contact is then responsible for working with the reporting director or officer to monitor and resolve the conflict of interest in accordance with our Code of Business Conduct and Ethics.

PROPOSAL 2

ADVISORY VOTE ON THE COMPENSATION

OF OUR NAMED EXECUTIVE OFFICERS

We are seeking advisory stockholder approval of the compensation of our named executive officers as disclosed in the section of this Proxy Statement entitled “Executive Compensation.” The proposal to approve the compensation of our named executive officers provides our stockholders with the opportunity to approve or not approve, on an advisory basis, the compensation of our named executive officers.

Although the advisory vote is non-binding, our Board and Independent Directors Committee will review the results and give consideration to the outcome of the vote in the future.

Approval of the proposal to approve compensation of our named executive officers requires the affirmative vote of the holders of at least a majority of the votes cast thereon. You may vote for or against or abstain on the proposal relating to compensation of our named executive officers. Abstentions and broker non-votes will not have an effect on the proposal relating to compensation of our executive officers. Proxies received will be voted “FOR” the proposal for compensation of our named executive officers unless stockholders designate otherwise. While our Board intends to carefully consider the results of the stockholder vote relating to the proposals on approval of compensation of our executive officers, the final vote will not be binding on us and is advisory in nature.

Presentation of Proposal Regarding Compensation of Our Named Executive Officers

We are presenting the following proposal, which gives you as a stockholder the opportunity to endorse or not endorse our executive compensation program for named executive officers by voting for or against the following resolution:

“—RESOLVED, that the stockholders approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission.”

OUR BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THIS PROPOSAL TO APPROVE THE COMPENSATION OF OUR EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT

ADDITIONAL INFORMATION

Stockholder Proposals

Any stockholder proposals for inclusion in our proxy materials for our 20182019 Annual Meeting of Stockholders must be received by our Corporate Secretary, Summit Healthcare REIT, Inc. 2 South Pointe Drive, Suite 100, Lake Forest, California 92630 no later than May 28, 2018.February 25, 2019.

In addition, nominations by stockholders of candidates for director or proposals of other business by stockholders must be submitted in accordance with our Bylaws. Our Bylaws currently provide that, in order for a stockholder to bring any business or nominations before the Annual Meeting of Stockholders, certain conditions set forth in Section 2.12 of our Bylaws, including delivery of notice of such proposal to our Corporate Secretary at the address above no earlier than April 28, 2018,January 26, 2019, and no later than MayFebruary 28, 2018.2019.

Our Corporate Secretary will provide a copy of our Bylaws to any stockholder of the Company upon written request and without charge.

We have adopted a process for stockholders to send communications to our Board. A description of the manner in which stockholders can send such communications appears above under “Communication with Directors.”

OTHER MATTERS

We are not aware of any other matter to be presented for action at the Annual Meeting other than those identified in the Notice of Annual Meeting of Stockholders and referred to in this Proxy Statement.

| BY ORDER OF THE BOARD OF DIRECTORS, | |

| Kent Eikanas | |

| President and Chief Operating Officer |

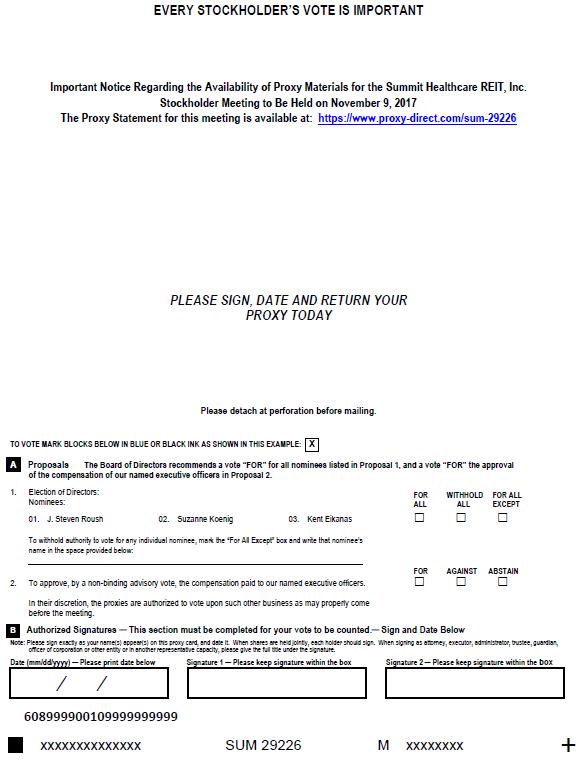

EVERY STOCKHOLDER’S VOTE IS IMPORTANT EASY VOTING OPTIONS: VOTE ON THE INTERNET Log on to: www.proxy-direct.com or scan the QR code Follow the on-screen instructions available 24 hours VOTE BY PHONE Call 1-800-337-3503 Follow the recorded instructions available 24 hours VOTE BY MAIL Vote, sign and date this Proxy Card and return in the postage-paid envelope VOTE IN PERSON Attend Stockholder Meeting 2 South Pointe Drive, Suite 100 Lake Forest, CA 92630 on November 9, 2017

| EASY VOTING OPTIONS: | ||

| VOTE ON THE INTERNET Log on to: www.proxy-direct.com or scan the QR code Follow the on-screen instructions available 24 hours | |

| VOTE BY PHONE Call 1-800-337-3503 Follow the recorded instructions available 24 hours | |

| VOTE BY MAIL Vote, sign and date this Proxy Card and return in the postage-paid envelope | |

| VOTE IN PERSON Attend Stockholder Meeting 2 South Pointe Drive, Suite 100 Lake Forest, CA 92630 on August 9, 2018 | |

Please detach at perforation before mailing. PROXY SUMMIT HEALTHCARE REIT, INC.

| PROXY | SUMMIT HEALTHCARE REIT, INC. |

ANNUAL MEETING OF STOCKHOLDERS – NOVEMBERAUGUST 9, 2017 2018

This Proxy Solicited on Behalf of the Board of Directors

The undersigned stockholder of Summit Healthcare REIT, Inc., a Maryland corporation (the “Company”), hereby appoints Elizabeth Pagliarini and Kent Eikanas, and each of them individually, the proxies of the undersigned with full power of substitution to vote at the Annual Meeting of Stockholders of the Company to be held at 2 South Pointe Drive, Suite 100, Lake Forest, California 92630, on NovemberAugust 9, 2017,2018, at 10:00 a.m. local time, and at any adjournment or postponement thereof, with all the power which the undersigned would have if personally present, hereby revoking any proxy heretofore given. The undersigned hereby acknowledges receipt of the proxy statement for the meeting and instructs the proxies to vote as directed on the reverse side.

The votes entitled to be cast by the stockholder will be cast as directed by the stockholder. If this proxy is executed but no direction is given, the votes entitled to be cast by the stockholder will be cast “FOR” all nominees listed in Proposal 1 “FOR” the approval of the compensation of our named executive officers in Proposal 2, and in the discretion of the proxy holder on any other matter that may properly come before the meeting or any adjournment or postponement thereof. VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-800-337-3503

| VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-800-337-3503 | |||

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED ON THE REVERSE SIDE. SUM_29226_091517

SUM_30010_061418

EVERY STOCKHOLDER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability of Proxy Materials for the Summit Healthcare REIT, Inc.

Stockholder Meeting to Be Held on NovemberAugust 9, 2017 2018

The Proxy Statement for this meeting is available at:https://www.proxy-direct.com/sum-29226 sum-30010

PLEASE SIGN, DATE AND RETURN YOUR

PROXY TODAY

Please detach at perforation before mailing.

TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: X A Proposals The Board of Directors recommends a vote “FOR” for all nominees listed in Proposal 1, and a vote “FOR” the approval of the compensation of our named executive officers in Proposal 2. FOR WITHHOLD FOR ALL ALL ALL EXCEPT Election of Directors: Nominees: 01. J. Steven Roush 02. Suzanne Koenig 03. Kent Eikanas To withhold authority to vote for any individual nominee, mark the “For All Except” box and write that nominee’s name in the space provided below: FOR AGAINST ABSTAIN 2. To approve, by a non-binding advisory vote, the compensation paid to our named executive officers. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting. B Authorized Signatures ─ This section must be completed for your vote to be counted.─ Sign and Date Below Note: Please sign exactly as your name(s) appear(s) on this proxy card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, administrator, trustee, guardian, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. Date (mm/dd/yyyy) ─ Please print date below Signature 1 ─ Please keep signature within the box Signature 2 ─ Please keep signature within the box 608999900109999999999 xxxxxxxxxxxxxx SUM 29226 M xxxxxxxxx

| A | Proposals | The Board of Directors recommends a vote “FOR” for all nominees listed in Proposal 1. |

| 1. | Election of Directors: | ||||||

| Nominees: | FOR ALL | WITHHOLD ALL | FOR ALL EXCEPT | ||||

| 01. J. Steven Roush | 02. Suzanne Koenig | 03. Kent Eikanas | ¨ | ¨ | ¨ |

| To withhold authority to vote for any individual nominee, mark the “For All Except” box and write that nominee’s name in the space provided below: | ||

| In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting. |

| B | Authorized Signatures ─ This section must be completed for your vote to be counted.─ Sign and Date Below |

| Note: | Please sign exactly as your name(s) appear(s) on this proxy card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. |

| Date (mm/dd/yyyy) ─ Please print date below | Signature 1 ─ Please keep signature within the box | Signature 2 ─ Please keep signature within the box | ||

| / / |

| Scanner bar code |

| xxxxxxxxxxxxxx | SUM 30010 | M | xxxxxxxx |  |